Latin America's copper projects seen as insufficient to avoid a deficit

Half of the world's copper is mined in Chile, Peru, Brazil, Panama and Mexico. But current operations and projects in the pipeline between now and 2030 are not enough to avoid an expected deficit in the market, consultants and experts foresee.

Global demand for the metal is forecast to reach 26.3Mt and supply 26.4Mt this year, says consultancy firm S&P Global. For its part, McKinsey projects that demand in 2031 will be 36.6Mt while supply will be only 30.1Mt.

Although the copper projects that are being developed in Latin America have the potential to reduce the deficit, they will not be able to eliminate it completely, says consultancy KPMG.

"One Escondida-type mine with capacity of 1Mt/y of copper would need to come on stream per year, in addition to a series of new projects. Otherwise, we will see a delay in supply for the energy transition and in the updates of the energy matrices," Michael Meding, VP of Canadian miner McEwen Copper, told BNamericas.

Recycling would not be enough to close the gap either, and the lower supply for wind turbines, photovoltaic panels, heat pumps, electric vehicles and energy efficiency would cause "an increase in the price of copper in the coming years," added Meding.

There are 29 large copper mining and/or smelting/refining operations in Chile, seven in Peru, two in Brazil, three in Mexico and one in Panama, according to the International Copper Association. Not even the 22 projects under construction and due to start up in 2022-29 in the region – according to the BNamericas database – would be able to completely satisfy global copper demand.

Those in the pipeline include the El Pachón, Los Azules, Josemaría, Filo del Sol, Taca Taca and Mara projects in Argentina that are due to start production before 2030.

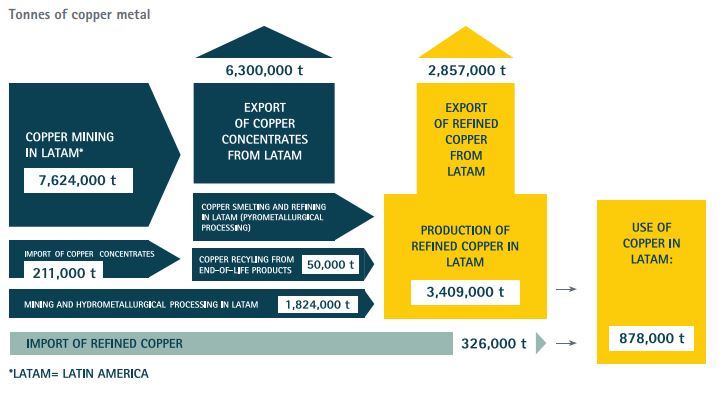

Nearly US$50bn is being invested in copper projects in Latin America that are scheduled to start production before the next decade. These would add some 3.2Mt/y to the current 7.6Mt/y produced in the continent.

Chile’s state copper commission Cochilco projects that the country’s production will grow 23% by 2033 compared to 2022, reaching 6.58Mt after hitting a peak of 7.14Mt in 2030.

Copper output in the world’s largest producer will grow mainly through brownfield projects such as Teck’s Carmen de Andacollo, state miner Codelco’s Andina, Capstone Copper’s Mantoverde and Antofagasta Minerals’ Los Pelambres, as well as Teck’s Quebrada Blanca II and Codelco’s new mine level at El Teniente.

Those projects alone require investment of US$13.5bn to add 889,000t/y once they start up, scheduled for this year and next.

BRAZIL

In Brazil, mining giant Vale's Salobo III project began operations in 2022 and expects to achieve an average of 352,500t/y of copper, reaching a maximum of 420,000t/y by 2026.

Nexa Resources expects to produce 4,000t/y of copper from its Aripuanã polymetallic mine in Mato Grosso state, and Ero Copper will start production at its Boa Esperança deposit in Pará state during the second half of 2024, adding some 20,000t/y in 2024-27.

PERU

In Peru, Anglo American is ramping up its Quellaveco mine to produce up to 350,000t/y and Minera Chinalco is in the final stage of the Toromocho expansion to increase output from 244,712t in 2022 to 300,000t/y.

Southern Copper's Tía María, Los Chancas and Michiquillay would produce 120,000t/y, 130,000t/y and 250,000t/y respectively by 2032, assuming they start up as planned. With the three, copper production in Peru would rise by 16%, CFO Raúl Jacob told the country's mining engineering institute recently.

MEXICO

In Mexico, Southern Copper’s Pilares, El Pilar and El Arco, all in Sonora state, are expected to contribute 35,000t/y, 36,000t/y and 190,000t/y of copper, respectively, once production begins between 2023 and 2028. Grupo México's Buenavista Zinc, in the same state, involves a concentrator to add 20,000t/y of copper, starting in the second half of this year.

And in Panama, First Quantum's Cobre Panamá produced 350,438t of the red metal in 2022 and is expanding.

Despite all these projects, the deficit is imminent, experts say. Along with raising production, Latin America’s mining industry faces the challenge of displacing China's supremacy in the supply of refined copper, Juan Carlos Jobet, a former Chilean energy and mining minister, told a critical minerals seminar hosted by Columbia University this week.

Latin America is key to the energy transition. In 2020, it produced close to 43% of the global total at 9.21Mt, with Chile representing 27.9%, Peru 10.3%, Mexico 3.7% and Brazil 1.7%, according to a study by the UN’s Eclac, but the region’s smelting capacity has decreased from a 21.9% global share in 1990 to 11.2% in 2020.

Subscribe to the leading business intelligence platform in Latin America with different tools for Providers, Contractors, Operators, Government, Legal, Financial and Insurance industries.

News in: Mining & Metals (Brazil)

Brazil's Nexa prices US$600mn bond issue

The notes mature in 2034 and will be used to refinance previous issues.

Creditors grant Horizonte Minerals temporary relief

The firm was allowed to postpone an interest payment, enabling it to keep looking for a solution to advance its Brazilian nickel project.

Subscribe to Latin America’s most trusted business intelligence platform.

Other projects in: Mining & Metals (Brazil)

Get critical information about thousands of Mining & Metals projects in Latin America: what stages they're in, capex, related companies, contacts and more.

- Project: Bluebush

- Current stage:

- Updated:

5 months ago

- Project: Mossoró

- Current stage:

- Updated:

5 months ago

- Project: Bacaba

- Current stage:

- Updated:

5 months ago

- Project: Apiacás

- Current stage:

- Updated:

5 months ago

- Project: Amargosa

- Current stage:

- Updated:

5 months ago

- Project: Projeto Novas Minas (PNM)

- Current stage:

- Updated:

5 months ago

- Project: Cajueiro

- Current stage:

- Updated:

5 months ago

- Project: Ariquemes (Bom Futuro)

- Current stage:

- Updated:

5 months ago

- Project: Diamante Santo Inácio

- Current stage:

- Updated:

5 months ago

- Project: Salobo IV

- Current stage:

- Updated:

5 months ago

Other companies in: Mining & Metals (Brazil)

Get critical information about thousands of Mining & Metals companies in Latin America: their projects, contacts, shareholders, related news and more.

- Company: Alfa Laval Ltda. (Alfa Laval Brasil)

-

Alfa Laval Ltda. (Brasil) is a subsidiary of Alfa Laval Corporate AB and is headquartered in São Paulo, Brazil. Established in 1959, the Brazilian branch has continued to expand...

- Company: Sociedade Michelin de Participaçoes Industrial e Comercio Ltda. (Sociedade Michelin de Participaçoes Industrial e Comercio)

-

Sociedade Michelin de Participaçoes Industrial e Comercio Ltda., a Brazilian subsidiary of French tire company Compagnie Générale des Établissements Michelin SCA, is engaged in ...

- Company: Companhia Brasileira de Alumínio (CBA)

-

Companhia Brasileira de Alumínio (CBA), born in 1941 and headquartered in São Paulo, is a Brazilian aluminum producer part of the local conglomerate Votorantim. CBA mines and sm...

- Company: Meridian Mineração Jaburi S.A. (Meridian Mineração Jaburi)

-

Meridian Mineração Jaburi S.A., a subsidiary of Amsterdam-headquartered Meridian Mining SE, is focused on the acquisition, exploration, development and mining of properties in B...

- Company: MCT Mineração Ltda. (MCT Mineração)

-

MCT Mineração Ltda., one of three Brazilian subsidiaries of US-based mining company Jaguar Mining Inc., is currently developing the gold Gurupi project in Brazil's Maranhão stat...

- Company: Aperam South America S.A. (Aperam South America)

-

Brazilian stainless steelmaker Aperam South America, formerly known as ArcelorMittal Inox Brasil, the local subsidiary of Aperam, manufactures specialty steels, particularly sta...

- Company: Samarco Mineração S.A. (Samarco)

-

Samarco Mineração S.A. is a Brazilian company engaged in the mining, beneficiation, pelletizing and export of iron ore. The firm's mining and beneficiation operations are locate...