How Chile's net zero quest could turn it into a decarbonization pioneer

Chile has charted an ambitious path towards net zero carbon emissions by 2050, and its power grid must change profoundly to get there.

The energy sector is the country's largest emitter, making up almost 80% of total CO2 output. Chile has vowed to retire its coal-fired capacity by 2040 and is working hard to replace that baseload power with a combination of hydro, wind, solar and battery storage, as well as a more robust transmission system.

But to achieve that in time, it will have to incorporate flexible and responsive natural gas-powered plants as well, according to an updated report on Chile's accelerated decarbonization path, published in September by Finnish company Wärtsilä.

In this email interview, BNamericas speaks to Silvia Zumarraga, general manager of market development at Wärtsilä Americas, to learn about the report's implications and its optimistic outlook on the future of the Chilean power grid.

[Editor's note: Q&A produced jointly with BNamericas Southern Cone bureau chief Allan Brown]

BNamericas: Wärtsilä has presented a practical way for Chile to decarbonize the electrical system by 2050. What are the main results and conclusions?

Zumarraga: I would like to start the answer with a thought. Imagine for a few moments that you wake up in 2050, or even before, and your power system has been the first in the world to reach full decarbonization, and the cost of the system has also gone down. Realizing this dream is now within our reach.

Chile has set some of the most ambitious decarbonization targets in the world. Our analysis presents a realistic decarbonization path for Chile, which achieves the country’s carbon reduction targets, serves the load without blackouts, and provides the lowest-cost supply for users. The study presents several stages and establishes important capacity mix-related decisions necessary for efficient decarbonization. Planning is the key for a successful decarbonization strategy to avoid incurring similar mistakes as those made by early-mover countries with ambitious decarbonization targets. Wärtsilä has published a white paper detailing this study.

Coal-fired power plants are a major source of power in Chile, so closing them provides a CO2 reduction of over 84% of the total power system emissions by 2030 when compared to 2021. But it is a monumental task that needs to be carefully considered. About 4GW of new generation capacity (mostly renewables) must be built each year during this decade to have a power system capable of serving the load without coal plants.

This power system with a high share of wind and solar must be able to operate reliably in different weather scenarios, including when facing weather forecast errors, such as extreme droughts or other long-lasting, unusual weather patterns. During the first decade, Chile will need 30GW of new assets:

• 5GW of wind power and 15GW of solar PV to produce a growing share of clean energy

• 8GW of battery storage, first for ancillary services, gradually increasing storage use for shifting solar power into the night as battery and solar prices decline.

• 2GW of flexible gas generation to provide the necessary firm capacity, and to avoid solar and wind curtailment caused by inflexible generation assets. These power plants will later be converted to sustainable fuels when these are available.

Chile will then be positioned as one of the global leaders in the decarbonization of the electricity sector, and an example for others to follow.

BNamericas: Based on the geography of the country and the challenges presented by the power grid, where and when would these additional resources need to be built?

Zumarraga: Chile is blessed with remarkable conditions for renewables, and if we look at the geography, most of the solar and storage will be located in the north, capturing high solar capacity factors, and shifting that energy to the night. Wind power will be in the mid-to-South regions, and the flexible gas power plants need to be strategically located in the system, where access to gas is available.

In terms of timeline, the study considers that, by 2030, Chile would have retired all 5GW of coal capacity and replaced them with 30GW of new generation capacity. As mentioned, at this point, the system would have achieved a 84% CO2 reduction. Then, between 2031 and 2050, the system will need an additional 30GW of new generation capacity (12GW solar, 11GW wind, 5GW storage and 3GW flexible thermal) to finally arrive at 100% renewables and zero fossil fuels.

After 2030, the study considers the closing of all inflexible and most fossil fuel assets. Then, as the last step of decarbonization, the flexible gas plants will switch to sustainable fuels such as hydrogen or hydrogen-derived fuels like ammonia or methanol. In summary, the system will need a total of over 60GW of additional capacity - compared to 2021 - to meet the load growth and be able to close all carbon emitting assets.

BNamericas: Do we have to wait until 2050 to achieve net zero? Could the timeline be shortened?

Zumarraga: This was one of our main questions after the study was completed. It was evident to us that a substantial effort was made in the first period (by 2030) to reduce carbon by over 80%, but it seemed the pace was slower during 2031-2050, when we needed to cut only the remaining 16% of the original 2021 carbon emissions. Therefore, we challenged ourselves and decided to find the answer. Could we maintain or improve the pace reliably?

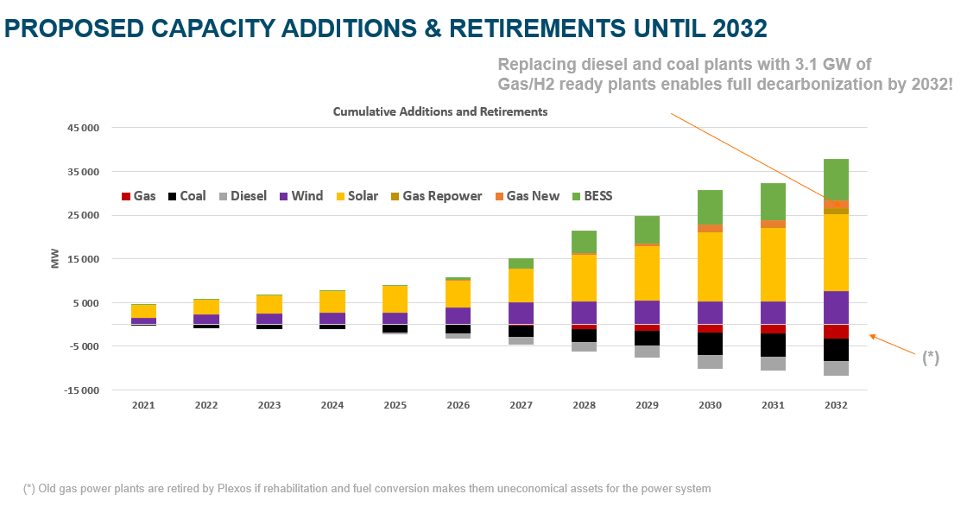

We set the team to model the system again with this question in mind, looking for ways to fully decarbonize the electric system within the next 10 years. When new results were obtained, we found out that not only is it technically possible but also economically affordable. The new modelling results show that Chile could decarbonize the electric system and achieve net zero by 2032.

BNamericas: What are the main differences between the first analysis versus the new, accelerated scenario?

Zumarraga: During the current decade, the differences are quite small. We see that the same amount of new generation capacity is needed. But, while in the first scenario all actions strived for zero carbon in 2050, by installing an additional 8GW of generation capacity during 2031 and 2032, Chile could achieve net zero by the end of 2032.

The capacity additions during 2031 and 2032 would consist of:

• 2.5GW of wind power

• 2.5GW of solar PV

• 1.5 GW of battery storage

• 1.5 GW of flexible gas generation

These capacity additions, along with converting all the flexible gas power plants to operate on either hydrogen, ammonia, or green methanol, enable Chile to reach zero carbon electricity by end of 2032.

Source: Wärtsilä.

BNamericas: A common perception is that decarbonizing electricity will cost a lot for end-users. How much more would Chileans have to pay for their clean power?

Zumarraga: It is a common belief that decarbonization will cost a lot more. However, this is not accurate, if it is planned and designed properly. Chile has very strong renewable wind and solar resources and the full utilization of them will not increase the end-user cost of electricity, as long as it is paired with flexible technology that can avoid curtailment. During this decade, heavy investments need to be made to be able to retire coal, but still, the electricity generation costs will stay very much the same as before. After the year 2030, the cost of electricity would start to decline, not to increase. The fact is, a major share of the cost of the system would be the capital required to build it, and not the cost of the fuel needed to operate the power plants. This would also decrease the country's dependence and exposure to the volatility of international fuel prices.

The difference in the cost of generation between the two scenarios is only 2.7%, which is minor compared to getting rid of 4mn tons of CO2 every year between 2033 and 2050.

BNamericas: A key point of your earlier comments is that replacing coal-fired generation capacity will not only require wind, solar and storage, but also balancing solutions, like flexible gas plants that can later be converted to e-fuels. Could you elaborate on why they are necessary?

Zumarraga: Renewable wind and solar energy – along with hydro – will provide the new base load energy for Chile. However, these plants are not dispatchable by the system operator like coal plants, because their output depends on the weather and time of day. Chile will balance these variations on the generation side, primarily with battery storage, keeping the power quality high and shifting energy from day to night and from windy times to calmer periods.

During the transition, when renewables and battery storage are being added, to cover an increasing share of the load, we see that there are moments when more energy is needed in the system. This energy is typically needed for short periods of time and flexible gas power plants can cover these needs, staying off-line when not needed and kicking in quickly when need arises. During the transition, these plants would typically operate around 1,500 hours per year.

Later, when the system is decarbonized and the flexible plants are operating on hydrogen-derived fuels, there will be times of unusual weather, when wind and/or solar plants do not generate enough power for extended periods, and battery storage gradually becomes drained. This is when the flexible plants come into the system, producing energy for a few hours and switching off when the sun comes out, and solar PV starts to charge the batteries. The short periods needed define the pulse operation for these plants.

It is important to remark that having these flexible power plants in the fleet enable substantial reduction of overbuilding wind and solar power installed capacities, creating a smaller power system and saving on costs. Without the relatively small fleet of flexible gas power plants, about 20GW of additional wind, solar and battery storage capacity would have to be installed to provide adequate energy through any and all-weather conditions, including extreme cases such as droughts and cold/hot waves.

Agility, dispatchability and high efficiency are key features for this flexible power system. To cover for unexpected weather forecast errors, the plants must be able to come online very fast (typically within five minutes), without incurring high starting costs. They must also operate at the highest possible efficiency (typically between 45-50%) and be able to go offline rapidly when not needed. These cycling and ramping capabilities will minimize the use of fuel and the production of carbon dioxide, balancing the intermittency caused by renewables, and will produce any energy not available from renewables and storage. It is important to point out that these power plants should be able to cycle multiple times per day, without adding extra maintenance cost to the system.

BNamericas: Using diesel-fired generation, which now plays an important role in balancing the grid, as a long-term solution seems non-viable in light of the decarbonization targets. Can the system work well without them?

Zumarraga: We have noted that many of the studies performed in Chile contemplate the exit of coal power plants, but somehow do not address the issue of diesel generation. Chile is one of only a handful of Western countries that rely on diesel power plants that are not just a reserve, but operate frequently. Such units use expensive fuel, operate on low efficiency, and produce high carbon emissions. And they cannot be a part of the clean, decarbonized power system of the future. So, finding fast ways to retire them is very important.

Our power system modelling is chronological with high granularity, and we have found that there is a clean way of achieving net zero without the diesel fuel plants. The study shows how replacing diesel oil generation with flexible gas power plants provides economic and environmental benefits:

- Gas power plants offer higher efficiency than diesel oil plants, reducing generation costs and carbon emissions during the transition.

- Flexible gas plants will be converted to sustainable fuels and play the same important role in maintaining system reliability after reaching net zero carbon as they did during the transition.

Wärtsilä has developed and offered flexible gas engines and battery storage solutions for many years and is deploying them all over the world. System planners, dispatchers and energy regulators are realizing the benefit and value of having these assets in the fleet to not only maximize the utilization of the renewable assets, but also to minimize the risk of uncertainties posed by variations in weather forecasts, climate change and unexpected demand conditions.

Subscribe to the leading business intelligence platform in Latin America with different tools for Providers, Contractors, Operators, Government, Legal, Financial and Insurance industries.

News in: Electric Power (Chile)

‘Coal generation is the smoking gun’

BNamericas talks to power generation and storage solutions company Wärtsilä about Chile’s decarbonization push and the solution it is offering.

Data Insights: Chile’s green hydrogen projects

BNamericas provides an overview of the project pipeline.

Subscribe to Latin America’s most trusted business intelligence platform.

Other projects in: Electric Power (Chile)

Get critical information about thousands of Electric Power projects in Latin America: what stages they're in, capex, related companies, contacts and more.

- Project: Infraestructura Energética Mejillones conversion to natural gas

- Current stage:

- Updated:

1 month ago

- Project: ERNC Tarapacá

- Current stage:

- Updated:

1 month ago

- Project: Tablaruca wind project (Alpaca portfolio )

- Current stage:

- Updated:

1 month ago

- Project: Sol de Caone photovoltaic park

- Current stage:

- Updated:

1 month ago

- Project: Estepa Solar Photovoltaic Park

- Current stage:

- Updated:

1 month ago

- Project: San Manuel wind farm

- Current stage:

- Updated:

1 month ago

- Project: Alto Solar Photovoltaic Park

- Current stage:

- Updated:

1 month ago

- Project: AR Valle Altillo Solar solar park

- Current stage:

- Updated:

1 month ago

- Project: Copiapó Energía Solar photovoltaic and storage park

- Current stage:

- Updated:

1 month ago

- Project: Los Lagos Hydroelectric Power Plant

- Current stage:

- Updated:

1 month ago

Other companies in: Electric Power (Chile)

Get critical information about thousands of Electric Power companies in Latin America: their projects, contacts, shareholders, related news and more.

- Company: Renergetica Chile S.p.A.

- Company: Pyxis Ingeniería SPA (Pyxis Ingeniería)

-

The description contained in this profile was taken directly from an official source and has not been edited or modified by BNamericas researchers, but may have been automatical...

- Company: Blue Light Energy SpA (Blue Light)

-

The description contained in this profile was taken directly from an official source and has not been edited or modified by BNamericas researchers, but may have been automatical...

- Company: Servicios Ambientales SpA

- Company: Eólica de la Costa SpA

- Company: Los Andes Transmisión S.A.

- Company: AES Andes S.A. (AES Andes)

-

AES Andes S.A., formerly AES Gener, is a subsidiary of AES Corporation with a presence in Argentina, Chile and Colombia. The company owns and operates a diverse portfolio of pow...